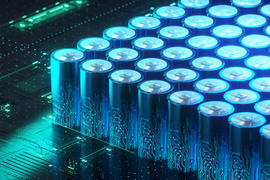

(JW Insights) Sep 8 -- China is building battery plants far beyond levels needed to meet domestic demand for electric cars and grid energy storage, underlining vast state subsidies and unchecked bank lending that are expected to underpin the international expansion of Chinese manufacturers, reported Financial Times on September 3.

Production capacity at China's battery factories is expected to reach 1,500 gigawatt hours this year - enough for 22mn EVs - more than twice demand levels, forecast at 636GWh, according to data from CRU Group, a research firm.

Battery manufacturers are following a pattern exhibited in other industries such as steel, aluminum, and solar panels, industry executives warned, where Chinese companies benefit from subsidies to take a huge share of the global market and squeeze out competition internationally, reported Financial Times.

“We are worried,” said Olivier Dufour, co-founder of Verkor, a French battery start-up backed by Renault. “What I see there is very similar to what I knew in aluminum. It's more than preoccupying,” added Dufour, a former executive at mining company Rio Tinto.

Regions of China are racing against each other to take advantage of government subsidies and become production epicenters for batteries in anticipation of surging future demand, risking a glut of production.

Based on announcements to build battery plants, the overcapacity is set to surge to nearly four times what the country needs by 2027, its data shows, and twice the volume of what China's entire car fleet would need to go completely electric by 2030, said data from CRU Group.

According to one senior western motor industry executive in China, manufacturers' expansion plans are “totally unrealistic” and have come despite hopes of industry consolidation. Now, as overcapacity issues worsen, there is a risk that more companies turn to exports.

In a presentation to EU officials seen by the FT, Verkor warned that a 500GWh supply gap in Europe in 2030 could be “compensated” by 1,100GWh of overcapacity in China.

While China is likely to face obstacles in flooding the global market with battery exports, its battery makers are being incentivized to set up locally because of protective policies and incentives in Washington and Brussels.

Despite bans and restrictions on its technology, China's battery manufacturers, including CATL, the world leader with 37 percent global market share, are planning to expand into the US and Europe.

Some argue overcapacity fears are overblown as batteries are poised to play a key role in China backing up electricity from intermittent renewable energy during a historic transition from coal, according to the Financial Times report.

(Li PP)