【本期受访人:《芯片战争》作者,塔夫茨大学弗莱彻学院国际历史副教授克里斯·米勒(Chris Miller)】

集微访谈:Miller先生你好,很高兴能有机会就美国“芯片法案”实施的新进展和你做一次交流。上个月,美国商务部表示,将对美国半导体行业的供应链和国防工业展开调查,以减少所谓“中国构成的国家安全风险”。美方发起的这项调查,将重点关注美国关键行业对中国制造的传统芯片的使用与采购情况,以评估其半导体供应链对中国芯片的依赖程度。那么,28nm以上的成熟制程的芯片,会不会成为未来中美半导体之争另一块前沿阵地?

Chris Miller:我不认为美国商务部的供应链审查和数据收集的行动意味着他们将为成熟芯片生产商提供更多资金。

《芯片法案》已经打算分配一些资金用于成熟的节点生产。我认为供应链审查是研究成熟节点市场,了解和研判中国成熟节点半导体产能大幅扩张将如何影响市场的几个步骤中的第一步。美国、欧盟和日本都非常担心中国对成熟节点建设的补贴会对全球半导体市场造成负面影响。不少业内人士担心成熟节点产能过剩。尽管如此,中国企业仍在迅速扩大工厂建设,这可能会加剧这一问题,我认为这很可能是中国与发达经济体未来的贸易争端的前奏。

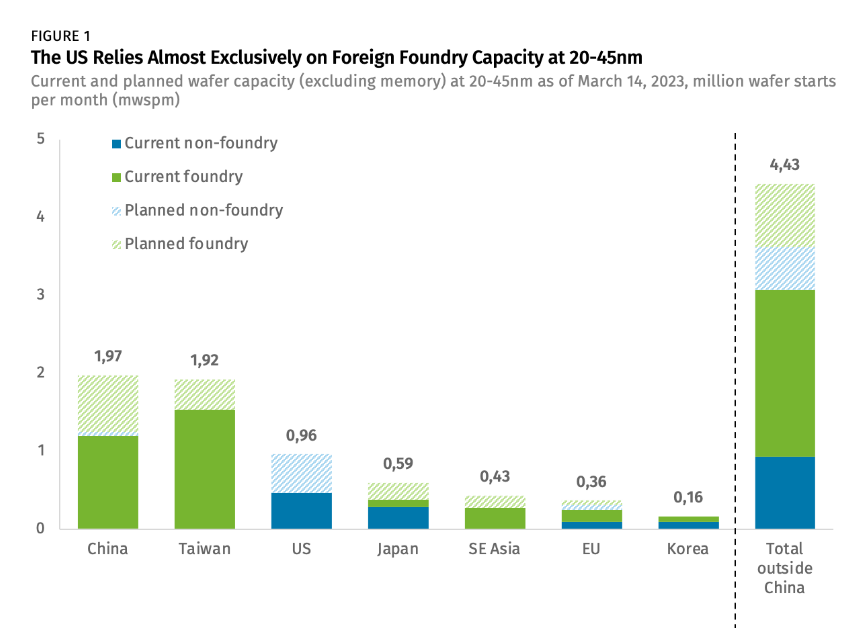

20nm-45nm成熟工艺芯片(不含存储),美国高度依赖海外市场(数据来源:SEMI)

集微访谈:《芯片法案》目前对企业方向已经有两笔款项落地,分别给了军工芯片承包商 BAE Systems和MCU大型供应商Microchip Technology。不过划拨的金额都不大,分别是3500万美元和1.62亿美元。从中我们能看出什么风向?

Chris Miller:前两笔赠款相对较小,因为完成小交易比大交易更容易,因此也更快。更大的赠款可能会在今年晚些时候发放。 但我确实认为,两笔最初的拨款表明,《芯片法案》将部分侧重于支持美国国防工业基地的需求以及产品广泛用于民用制造基地的MCU生产商。

集微访谈:负责“芯片法案”拨款的重要人物之一是美国参议院拨款小组委员会主席珍妮·沙欣 (Jeanne Shaheen) ,她也是来自新罕布什尔州的美国资深参议员,BAE的一个重要的制造基地,微电子中心 (MEC) 位于新罕布什尔州Nashua。我们是否可以得出结论,她动用了个人政治资源促成了这笔款项的落地?

Chris Miller:事情不是这样的。评估拨款的团队完全不受国会直接政治压力的影响。国会会施加一些压力,但公司必须提交详细的资金申请计划,这些申请要经过专业人士的审查,并且还要经过公司和政府之间的广泛谈判。BAE获得资助主要是因为其在军事系统生产方面的作用。

集微访谈:“芯片法案”第二笔面向企业的重大拨款给了Microchip,这也是俄勒冈企业拿到的第一笔重要拨款。与加州、得州、纽约州等传统科技中心州相比,俄勒冈州在税收政策、劳动力和建筑成本方面有何优势?

Chris Miller:俄勒冈州是美国芯片制造的主要地点。例如,英特尔在那里拥有大量制造基地和基础设施,Microchip在俄勒冈州也设有工厂。(校对/朱秩磊)

(附 英文版邮件采访)

ijiwei Talk:Department of Commerce is taking proactive measures to assess the U.S. semiconductor supply chain by collecting data from U.S. companies on the sourcing of their legacy chips.Does this indicate Commerce Department will distribute more funds to legacy chips fabs instead of cutting edge manufacturers?Based on the announcement of Department of Commerce last December, will the mature-nodes semiconductor be the new US-Sino high tech battle field from now on?

Chris Miller: I don't think the supply chain review and data collection means that the Commerce Department will give more funds to legacy producers. The Chips Act already intended to allocate some funds to mature node production. I think the supply chain review is the first of what will be several steps to study the mature node market and understand how the vast expansion in China's production capacity for mature node semiconductors will impact the market. In Washington as well as in Brussels and Tokyo there is deep concern that China's subsidies for mature node construction will distort the market. Many industry players worry about overcapacity in mature nodes. Chinese firms are nevertheless rapidly expanding factory construction, which could exacerbate this issue. I think this is likely to be a future trade dispute between China and advanced economies.

ijiwei Talk:Biden administration chooses BAE Systems for first Chips Act grant, and its second grant under a new program would help Microchip Technology. Could we summarize some similarities or resemblances between these two grants ( military related, relatively small award, and....)?

Chris Miller: I think the first two grants were relatively small because it is easier -- and thus faster -- to finish small deals rather than big ones. The bigger grants will likely come later this year. But I do think the two initial grants show that the Chips Act will focus in part on supporting US defense industrial base needs as well as microcontroller producers whose products are used widely in the civilian manufacturing base.

ijiwei Talk:Jeanne Shaheen, chair of the U.S. Senate Appropriations Subcommittee that funds the Department of Commerce, is also the senior United States senator from New Hampshire, and BAE Systems’ Microelectronics Center (MEC) is in Nashua,New Hampshire. Could we conclude, she is the one who facilitates this deal?

Chris Miller:No, that's not how it works. The team assessing grants is fairly insulated from direct political pressure from Congress. There will be some Congressional pressure, but companies have to submit detailed applications for funds that are vetted by professionals and involve extensive negotiations between companies and the government. The fact that BAE got a grant is primarily due to its role in producing for military systems.

ijiwei Talk:As for Microchip, It’s the second major grant under the $52 billion CHIPS Act legislation Congress approved in 2022 and the first to an Oregon manufacturer. Comparing to the traditional tech-hub states such as California, Texas, New York, what’ the advantage of Oregon, regarding tax policies, labor forces and building costs?

Chris Miller: Oregon is a major location for chipmaking in the US. Intel has substantial facilities there, for example. Microchip is building there because it already has facilities in Oregon.